How to Build a Cash Flow Dashboard Template That Helps You Stay Ahead

The High Stakes of Poor Cash Flow Management

Organizations that fail to monitor their cash flow will develop liquidity issues which can result in operational failures. The failure to monitor cash flow properly results in delayed vendor payments and missed payroll obligations and restricted access to credit. The lack of cash visibility leads to supplier distrust and employee distrust and credit rating deterioration and restricted business expansion possibilities.

The economic environment presents high risks to businesses which do not establish forward-thinking cash management systems. Organizations that lack proactive cash management strategies will struggle to adapt to external market changes including interest rate increases and supply chain interruptions and customer behavior shifts. Leaders can use a cash flow dashboard to detect cash deficits and determine funding requirements and make early interventions which stop problems from escalating into major issues.

Organizations use dashboards as their core financial management tools which they implement strategically.

A cash flow dashboard designed correctly helps businesses transition from financial data monitoring to strategic financial planning operations. The finance team monitors their current cash positions through their dashboard instead of searching multiple spreadsheets or waiting for monthly reports. The dashboard provides real-time cash visibility which enables daily financial decisions and enables fast cash flow problem resolution and promotes financial performance accountability throughout the organization.

The dashboard system enables departments to share financial data through its improved communication features. The sales team can match their payment schedules with expected cash availability while procurement staff can use financial information to plan their buying activities and leadership can start expansion initiatives and reduce expenses without facing any doubts. The dashboard functions as an organizational reference point which provides all team members with financial information understanding.

What Is a Cash Flow Dashboard Template?

A cash flow dashboard template functions as a pre-designed system which enables organizations to monitor and analyze their cash movements. The template functions as a starting point to develop customized dashboards which meet requirements of different organizations. The template creates a single platform which displays all essential cash metrics for organizations to track their cash flow operations.

The template contains separate areas to monitor revenue entries and operational costs and capital spending and funding activities and total cash reserves. The system includes two core elements which show predicted cash performance against actual results and notify users about approaching financial issues. The template achieves its strength through its ability to transform complicated financial information into useful information which users can use for acting.

Key Features of the Template

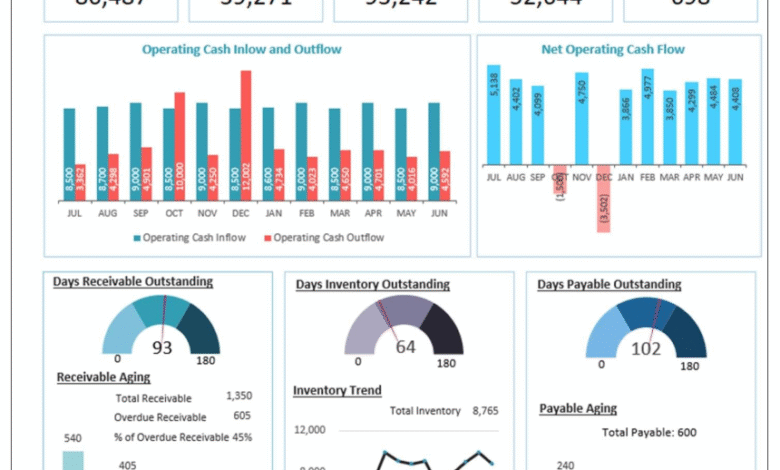

The most successful cash flow dashboard templates provide users with real-time data updates and simple-to-understand visualizations and customizable data filtering options. The dashboard maintains real-time financial data integration which produces immediate updates financial data in real-time to prevent delays and maintain accuracy. The dashboard shows financial data through basic visual components which include trend lines and gauges and charts to enable users for performance pattern recognition and rapid decision-making.

Users can access different data segments through interactive dashboard features which allow them to select specific time periods and departments and transaction categories. The system enables users to perform detailed cash flow analysis through its adaptable structure which shows the fundamental elements causing their financial variations. The template design needs to support various user needs through its ability to show both basic financial data and extensive financial details.

Essential Metrics to Include in Your Cash Flow Dashboard

A successful cash flow dashboard requires essential metrics which deliver complete liquidity health information to users. Organizations need to track their cash inflows and outflows as their fundamental financial metric. The financial inflows of a business consist of customer payments and loan proceeds and investment returns, but the financial outflows consist of employee salaries and rent payments and supplier costs and tax payments and debt repayment. Real-time financial element tracking allows businesses to continuously monitor their funding sources and payment responsibilities.

The net cash flow indicator shows the complete amount of cash that moves into or out of the business throughout a specific time span. A business needs to implement cost reduction measures and investment delays and new funding solutions when its net cash flow remains negative throughout multiple periods. A business generates successful operations through positive net cash flow which provides financial flexibility.

The organization supports its total cash position through its available cash and cash equivalents. The organization maintains enough liquidity through this metric because it shows the company can meet its short-term financial responsibilities. The organization needs to determine its payment order and capital expenditure timeline based on its available current cash reserves.

Several tools exist for building cash flow dashboard templates which range from basic spreadsheet applications to sophisticated business intelligence platforms. Users should begin with Excel and Google Sheets because these tools provide fundamental access and flexible functionality. The first dashboard tools for new small businesses and organizations prove to be appropriate for their requirements. Users can establish automatic dashboards which update themselves through new data availability when they organize their data correctly and possess spreadsheet expertise.

Power BI and Tableau and Google Data Studio serve as the best dashboard solutions for organizations that need to handle intricate operations and generate sophisticated reports. The platforms enable direct database connections to accounting systems and ERP software and cloud-based databases. The platforms allow users to build interactive dashboards which include filtering options and real-time data refresh and multiple user access for teams that need integrated workflows.

The design process for cash flow dashboards needs skills which go beyond basic technical competencies. Users need to understand how financial data affects their work activities and determine which information they need to perform their decision-making duties. The dashboard interface should show information through a specific order which begins with showing the most critical data points first. The dashboard needs two essential sections to show net cash flow and cash position data while using additional sections for complete analysis.

The dashboard interface should show information through simple visual elements which help users avoid information overload from excessive data points. The dashboard needs to show data through basic visual components which provide easy understanding. The dashboard components serve two main purposes which include supporting decision-making activities and fulfilling specific functions. The dashboard presents data through visual indicators which display changes and potential problems through color schemes and trend arrows.

The implementation of automation technology leads to better efficiency in dashboard maintenance operations. The dashboard needs to receive its data from real-time sources while it runs automatic data update processes. The system maintains active current data which automatically updates dashboard information without needing user input. The system produces exact results at high speed through its automated calculation system and visual update functions.

Conclusion: Make Better Decisions with a Forward-Looking Cash Flow Dashboard

A cash flow dashboard functions as a tool which provides benefits that go beyond its role as a financial reporting system. The dashboard functions as a strategic platform which helps organizations detect upcoming challenges and find new business prospects and optimize their resource utilization. The dashboard provides users with better liquidity understanding through visual presentation and real-time updates and financial strategy alignment which enables them to make enhanced decisions. Bizinfograph offers ready-to-use dashboard templates on Finance, Sales, HR and Manufacturing.